Why UK Businesses use Square POS

- Free to start: The base POS app is free, with paid plans available as you scale.

- No contracts or setup fees: Perfect for startups or seasonal traders who want flexibility.

- Beautiful, intuitive interface: Staff learn it instantly — the touchscreen layout feels natural.

- Integrated card payments: Works with Square’s own readers and terminals; funds usually clear next day.

- Online store sync: Free online store option to take orders, bookings, or click & collect.

- Hospitality-ready tools: Manage tables, split bills, track modifiers, and send orders to the kitchen.

- Powerful analytics: Real-time sales reports, customer trends, and employee insights on any device.

- Add-ons when you’re ready: Payroll, invoices, marketing, and loyalty tools — all within the same platform.

💷 Pricing: While there is a free, basic version, the Square paid plans start at £69/mo. With the free plan you would have to take the Square payment processing devices which cost like 1.75% per transaction. They are pretty transparent about how much their hardware costs on the website.

What users say about Square.

“The card reader is super reliable — and the next-day payouts help our cash flow more than we expected.”

“We started with Zettle but switched to Square because of the reporting. The daily summaries make it easy to see what’s working.”

— James T., retail owner, Manchester

“Square has that Apple-like polish — it just works, and it makes small businesses feel big.”

Square POS is one of the most user-friendly, cost-effective systems for small UK businesses that want to get started quickly with no setup headaches and everything under one roof. It’s not built for highly complex multi-site operations, but for solo traders, cafés, salons, and pop-ups.

Zettle POS by Paypal

If you’re looking for a straightforward POS that’s easy to set up, affordable to run, and backed by a trusted name, Zettle by PayPal is a brilliant choice. Formerly known as iZettle, this system has become a UK favourite among small retailers, baristas, and market traders who want no-fuss payment processing with solid POS functionality.

The best part? It integrates seamlessly with PayPal, meaning you can take in-person, online, and PayPal payments all through one connected ecosystem — ideal for small businesses selling across channels.

“We’re a tiny team and Zettle just makes sense — the card reader, app, and reports are simple but reliable. And we love the PayPal payouts.”

— Amy S., boutique owner, Glasgow

Features from Zettle

- Plug-and-play simplicity: Download the app, pair the reader, and start selling in minutes.

- Affordable hardware: The Zettle card reader costs around £59, and it’s sleek, portable, and durable.

- No monthly fees: You only pay a 1.75% per-transaction fee — perfect for businesses with variable turnover.

- Inventory management: Track products, categories, and variants with ease.

- Sales reporting: View daily and monthly performance right in the app or web dashboard.

- PayPal integration: Get access to PayPal’s massive ecosystem — including instant payouts and online checkout options.

- Multi-user access: Add team members, track sales, and control permissions.

- Integrations: Connects with accounting tools like Xero and QuickBooks, and with eCommerce platforms like Shopify.

💷 Price: Zettle POS has a one-time cost of £149 and a 1.75% processing fee

Even more than Sumup and Square, Zettle by PayPal is ideal for small and mobile UK businesses that want simplicity, reliability, and transparent pricing. It may not have the deep features of Lightspeed or Epos Now, but for those who just want to take payments, track sales, and grow confidently, it’s hard to beat for the price.

What UK Zettle say

“Zettle is perfect for our weekend market stall. The setup took ten minutes, and the app has everything we need.”

— Fiona L., artisan baker, Bristol

“We love how it connects to PayPal — payments are quick, reports are clear, and there’s no subscription to worry about.”

— Small Boutique, London

“Zettle feels designed for small business owners — simple, affordable, and genuinely stress-free.”

— Market stand, London

Clover POS

Clover POS is the choice for UK businesses that want a polished, all-in-one system — hardware, software, and payments that just works together. Owned by Fiserv, Clover is popular among mid-sized retailers, cafés, and salons that are outgrowing entry-level setups like Square or Zettle but don’t want the complexity of enterprise systems like Lightspeed. It has offices in London and other parts of the United Kingdom.

Clover stands out for its plug-and-play hardware, modern design, and flexible app-based approach: you start with the basics and add tools as your business grows — from staff scheduling to loyalty programs and gift cards. They are best used for retail shops, restaurants and salons where they use countertop POS systems. You can scale quite a bit with Clover.

“We upgraded to Clover after outgrowing Zettle, and it’s been a game-changer. The reporting and customisable apps make a big difference day-to-day.”

— Rachel P., restaurant owner, London

Clover features

- All-in-one solution: Hardware, software, and payments are built to work seamlessly together.

- Sleek hardware options: From compact handhelds to full countertop terminals like Clover Station and Mini.

- Customisable apps: Choose from hundreds of add-ons to manage loyalty, scheduling, invoicing, and more.

- Retail & hospitality flexibility: Works equally well for cafés, salons, and retail stores.

- Inventory management: Track products, categories, and variants in real time.

- Staff management: Control permissions, track shifts, and view performance reports.

- Integrated payments: Accept all major cards and digital wallets with transparent processing fees.

- Cloud access: Manage your business from any device, anywhere.

💷 Price: Clover POS pricing start at £100/mo depending on plan and hardware. Hardware typically starts at £499 for countertop setup. Transaction fees are around 1.5%-1.75% per card payment.

What UK users say about Clover

“It looks smart on the counter, and our staff love how simple it is to use. Reports are detailed but easy to understand.”

— Darren T., salon owner, Leeds

“It’s a great middle ground — not as basic as SumUp or Zettle, but not overly complex like some restaurant systems.”

— Quick service restaurant, London

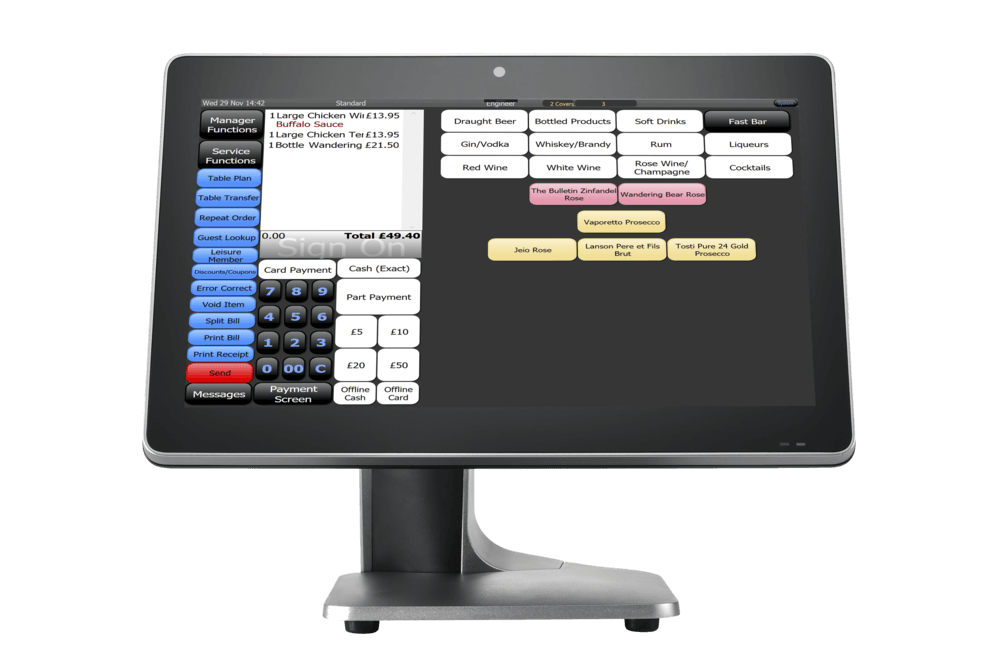

Tevalis EPOS

Tevalis POS stands in a league of its own. Headquartered in Hull, Tevalis powers everything from fine dining restaurants and hotels to national food chains and leisure venues. Unlike off-the-shelf systems, Tevalis builds tailored setups — meaning every feature, workflow, and integration is configured around how your business actually runs. It’s a system designed not just to take payments, but to give operators complete visibility and control over every aspect of their operation. That is why they are mostly used for bigger restaurants, hotels, hospitality chai and multi-site groups. Also very popular for vacation parks, zoo’s, theaters and other organisation with multiple POS points.

Features

- Fully customisable system: Every setup is tailored for your venue type — from fine dining and QSRs to hotels or stadiums.

- Table service excellence: Intuitive table layouts, course management, and handheld ordering for front-of-house teams.

- Real-time insights: Advanced analytics dashboards showing sales, covers, labour costs, and profit margins in real time.

- Seamless integrations: Connects with top accounting, reservations, and stock platforms (including Xero, SevenRooms, and Fourth).

- Kitchen Display System (KDS): Speeds up service with instant communication between front and back of house.

- Enterprise management: Perfect for multi-site operators, offering consolidated reporting and centralised menu control.

Dedicated UK support: In-house technical and training teams based in England.

💷 Price: To give an indication, Tevalis POS pricing starts at £100/mo. But usually the offering is tailored and more expensive what you would expect.

“Tevalis is easily the most robust system we’ve used — fast, flexible, and the support team are fantastic.”

— Operations Director, London hotel group

“The reporting alone has changed how we make decisions. It’s like having a control centre for the business.”

— Fun park centre, Liverpool

Syrve POS

Syrve POS (formerly known as iiko) is one of the more innovative hospitality POS platforms in the UK, built for operators who want real-time insights and automation, not just a till. It’s widely used by restaurants, bars, takeaways, and even franchises that want to bring together sales, inventory, and staff management in one intelligent platform. They promote themselves as data-driven with loads of insights. Their UK offices are at Innovation Centre, Gallows Hill, Warwick, CV34 6UW, United Kingdom.

Syrve is mostly used by for busy kitchens, quick-service restaurants, and multi-site operators that want to scale efficiently and stay in control of every moving part.

Features

- Real-time data tracking for cost and labour management

- Enhanced customer experience tools for loyalty and sales

- Faster transactions to reduce queues

- Handheld POS for efficient tableside service

- Real-time inventory and cost control

- Cutting-edge technology for seamless operations

- Intuitive design for ease of use

- Comprehensive order management capabilities

- Tableside service functionality

💷 Price: Syrve POS pricing starts at £49/mo

“Syrve gives us live data — I can see sales, staff costs, and stock in real time, which helps us make fast decisions.”

— Emma L., restaurant manager, Birmingham

“Syrve feels like having a restaurant command centre. It’s not just POS — it runs everything from inventory to payroll.”

— Raj P., franchise owner, London

Micros POS (Oracle)

When you see a sleek POS running in a busy hotel, a stadium bar, or a global restaurant chain — there’s a good chance it’s Oracle Micros. This system is one of the most established and trusted enterprise POS solutions in the world, with decades of hospitality experience behind it.

In the UK, Micros is widely used by large restaurants, hotel groups, leisure venues, and quick-service franchises that demand reliability, speed, and multi-location control. It’s not built for microbusinesses — it’s for operations where uptime, consistency, and data accuracy are mission-critical.

“Micros is the backbone of our restaurant group — fast, stable, and fully integrated with our hotel PMS. It just works, even on our busiest nights.”

— Richard H., hotel F&B director, London

Features

- Advanced order management system

- Integrated payment processing

- Customisable menus and layouts

- Comprehensive inventory management

- Customer relationship management tools

- Reporting and analytics functionalities

- Multi-location management capabilities

- Mobile POS options for flexibility

- E-commerce integration for omnichannel sales strategies

💷 Price: Micros POS does not publish the pricing plans on the website

“We’ve tried other systems, but nothing matches Micros for stability. It’s built for serious volume.”

— Hospitality IT Manager, London

ePOS system cost and pricing comparison

| ePOS system provider |

Pricing p/m starting |

Best suited businesstype |

| Lightspeed POS |

£59.00 |

Retail, Hospitality, Golf |

| Squareup POS |

£69.00 |

Counterservice retail and hospitality |

| Eposnow |

£25.00 |

Bakery, Pizza, Retail, restaurant |

| Sumup POS |

£49.00 |

Small restaurant, cafe |

| Clover POS |

£100.00 |

Hair, Repair services, personal services |

| ICRTouch |

na |

Convenient store, pubs, events |

| NCR (Aloha) |

£175.00 |

Supermarket, Large stores |

| Sunmi POS |

£29.00 |

Small shops |

| Zettle POS |

£149 + 1.75% |

Small retail, foodtrucks |

| Syvre |

£49.00 |

Hospitality |

What You Get From Us

Choosing the right POS system is not just about software. It is about expert guidance, transparent pricing, and a support system that grows with your business. Here’s what you will get from us:

-

Trusted, expert-written content

Our team of POS and payment specialists creates clear, reliable, and well-researched content tailored for UK businesses.

-

Real-life pricing scenarios

We provide accurate pricing examples and cost breakdowns, helping businesses plan confidently without unpleasant surprises later.

-

Industry-based recommendations

Our guidance is tailored for start-ups, franchises, and pop-ups, ensuring every business gets relevant, practical solutions.

-

Legal and compliance basics

We simplify PCI, SCA, VAT, and receipts compliance so businesses understand and meet essential legal obligations easily.

-

Lifetime support as you grow

We offer ongoing guidance, updates, and resources so your POS setup always aligns with your changing business needs.

Get matched now

Start Your Free POS Match Today

You are two minutes away from your tailored POS shortlist.

No hidden costs. No commitments. Just the best options for your business.

Get matched now

Start a free trial